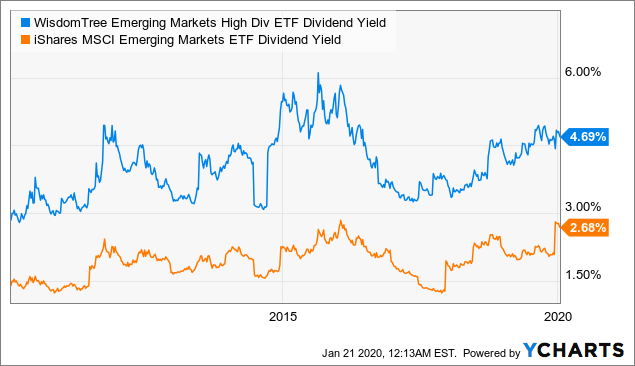

The dividends in the fund are distributed to the investors Quarterly. DVYE is the best emerging market dividend ETF with DEM coming in a close second.

Wisdomtree Emerging Markets High Dividend Etf 4 7 Yield And Upside On Improving Macro Outlook Nysearca Dem Seeking Alpha

Wisdomtree Emerging Markets High Dividend Etf 4 7 Yield And Upside On Improving Macro Outlook Nysearca Dem Seeking Alpha

The index is designed to capture the performance of companies in MSCI EM that have consistently increased dividends every.

Emerging markets dividend. JPMorgan Funds - Emerging Markets Dividend Fund C div - EUR. The investment objective of the Fund is to provide investors with a net total return taking into account both capital and income returns which reflects the return of the Dow Jones Emerging Markets Select Dividend Index. Maar dit is wel een hele belangrijke en interessante ETF dus heb ik hem er maar wel onder gezet.

Fund expenses including management fees and other expenses were deducted. Doel iShares Emerging Markets Dividend-ETF Het bedrijf mag geen verlies maken. To provide income by investing primarily in dividend-yielding equity securities of emerging market companies whilst participating in long term capital growth.

The fund replicates the performance of the underlying index by buying a selection of the most relevant index constituents. DEM has an expense ratio of 063 and tracks the. Nu is hoog dividend uiteraard geen sector.

In order to achieve this investment objective. IShares Emerging Markets Dividend ETF The Hypothetical Growth of 10000 chart reflects a hypothetical 10000 investment and assumes reinvestment of dividends and capital gains. The MSCI Emerging Markets High Dividend Yield Index is based on the MSCI Emerging Markets Index its parent index and includes large and mid cap stocks across 27 Emerging Markets EM countries.

The total expense ratio amounts to 065 pa. The previous Vanguard FTSE Emerging Markets UCITS ETF dividend was 113c and it went ex 2 months ago and it was paid 2 months ago. Marktkapitalisatie is het aantal uitstaande.

De Frontier Markets vormen dus eigenlijk de kraamkamer voor de volgende generatie Emerging Markets. Deze ETF van SPDR richt zich volledig op hoog dividend uitbetalende aandelen uit emerging markets. De SP Emerging Markets High Yield Dividend Aristocrats Index werd ontworpen om de prestaties te meten van ondernemingen binnen de SP Emerging Plus LargeMidCap Index die hoge dividenden uitkeren en die hun dividenden al.

SPDR SP Emerging Markets Dividend UCITS ETF Meer dan 100 aandelen uit emerging markets die nog steeds een hoog dividend kunnen betalen. Het feest is wel een beetje over bij de emerging markets. In contrast there are lesser-known stocks in emerging markets that may seem more risky but in fact are developing a strong history of delivering shareholder value through consistent.

The index is designed to reflect the performance of equities in the parent index excluding REITs with higher dividend income and quality. 18 rijen Emerging Market Dividend ETFs focus on dividend-paying equities domiciled. DEM tracks a dividend-weighted index of emerging market stocks ranked in the top 30 by dividend yield.

Daarnaast lijken juist deze Frontier Markets zich goed te lenen voor de hoog dividend fondsen. Het bedrijf dient een voldoende grote marktkapitalisatie te hebben. IShares EM Dividend UCITS ETF USD Dist EUR EUNY.

Uit eigen onderzoek blijkt dat de strategie van dividendbeleggen de afgelopen jaren bijzonder goed heeft gewerkt. De waarde en het rendement van beleggingen kunnen dalen en stijgen en zijn niet gegarandeerd. JPMorgan Funds - Emerging Markets Dividend Fund A div - EUR To provide income by investing primarily in dividend-yielding equity securities of emerging market companies whilst participating in long term capital growth.

Het aandeel dient de afgelopen 3 jaar dividend uitgekeerd te hebben. Het fonds streeft ernaar het rendement te volgen van een index die bestaat uit 100 aandelen van ondernemingen uit opkomende markten die een bovengemiddeld dividendrendement bieden. DGRE is the best emerging market dividend growth ETF.

SPDR S and P Emerging Markets Dividend UCITS ETF. The iShares Emerging Markets Dividend UCITS ETF invests in stocks with focus Dividend Emerging Markets. There are typically 4 dividends per year excluding specials and the dividend cover is approximately 10.