Leveraged mutual funds seek to provide a multiple of the investment returns of a given index or benchmark on a daily or monthly basis. The Overall Morningstar Ratings are derived from a weighted average of the risk adjusted performance figures associated with a Funds 3- 5- and 10-year if applicable Morningstar Rating metrics.

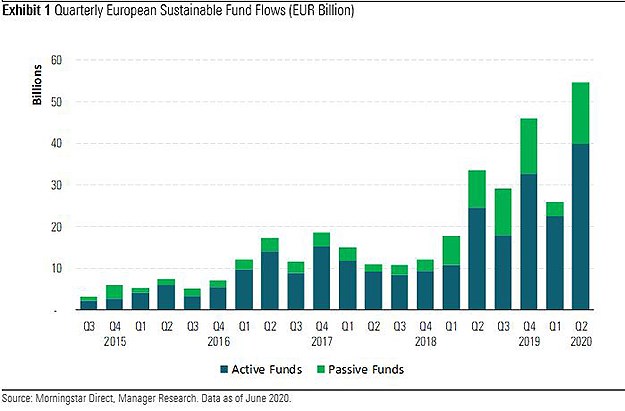

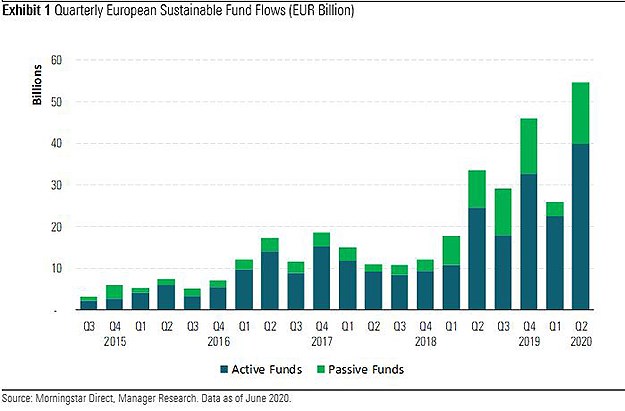

Sustainable Fund Flows Hit Record In Q2 Morningstar

Sustainable Fund Flows Hit Record In Q2 Morningstar

Money Market Taxable Money Market Tax-Free Money Market Non-40 Act Prime Money Market Trading Leveraged Commodities Trading Inverse Commodities Trading Leveraged Debt Trading Inverse Debt Trading Leveraged.

Leveraged mutual funds morningstar. A funds Morningstar Rating is a quantitative assessment of a funds past performance that accounts for both risk and return with funds earning between 1 and 5 stars. Four components drive the Star Rating. See locating the leverage status using the closed-end fund screener for more information.

This process culminates in a single-point star rating that is updated daily. Any Category average 200 150 100 050. A high rating alone is not sufficient basis upon which to make an investment decision.

Below we feature some of the best rated and best performing leveraged mutual funds based on Morningstar with at least 100 million assets under management are as follows. As always this rating system is designed to be used as a first step in the fund evaluation process. Morningstars Research Committee evaluates the Category Morningstar Risk.

1 our assessment of the firms economic moat 2 our estimate of the stocks fair value 3 our uncertainty around that fair value estimate and 4 the current market price. Inverse mutual funds seek to provide the opposite of the. However the second and third waves of ETFs often leveraged andor investing in futures are something different.

Morningstar India Private Limited. Rydex SP 500 2X Strategy Fund RYTTX. Since the financial crisis the markets for Bank Loan BL and High Yield Bond HYB mutual funds MFs have grown significantly with assets under management increasing from 19 billion and 75.

The fund has returned 11578 percent over the past year 3832 percent over the past three years 3792 percent over the past five years and 2556 percent over the past decade. 2 As of April 1 2018 Morningstar classified open-end mutual funds and exchange-traded funds into 123 categories. Mutual funds do not melt down in that fashion nor did the first wave of ETFs.

At the end of the period the fund will have increased in value by 125 million 10 of 125 million representing a 125 return on the 100 million of its own assets invested by the fund. All No-load funds only. Minimum initial purchase less than or equal to.

Leveraged loans are senior in a companys capital structure but are typically extended to risky borrowers and invariably vulnerable in a credit crisis. Morningstar Risk is the difference between the Morningstar Return based on fund total returns and the Morningstar Risk Adjusted Return based on fund total returns adjusted for performance volatility. You now have 36000 so you choose to sell out.

9th floor Platinum Technopark Plot No. Expense ratio less than or equal to. VelocityShares 3x Long Silver ETN Linked to the SP GSCI Silver Index ER USLV.

Morningstar India Help Desk e-mail. A 5-star represents a belief that the stock. 5 from preferred shares 10 in net asset value 50.

This CEF has a leverage ratio of 50 computed as capital from preferred shares divided by net asset value. Morningstar assigns star ratings based on an analysts estimate of a stocks fair value. After pumping in so much money in 2013.

Leveraged mutual funds seek to provide a multiple of the investment returns of a given index or benchmark on a daily or monthly basis. On your DSC funds the exit commission is 6 of 40000 the original amount of investment a cost of 2400. Profunds Biotechnology UltraSector Fund BIPIX SP 500.

Morningstars Scorecard calculations do not include funds in the following categories. Inverse mutual funds seek to provide the opposite of the. Your net proceeds are 33600 and you repay the 30000 leverage loan leaving you with only 3600 or 36 of your the original 10000.

More companies such as Direxion followed suit and according to data from Morningstar there are now more than 170 leveraged ETFs with over. The Overall Morningstar Ratings are derived from a weighted average of the risk adjusted performance figures associated with a Funds 3- 5- and 10-year if applicable Morningstar Rating metrics. Leverage magnifies returns both.

The Category Risk Level is based on the equal weighted average Morningstar Risk of the funds in the category. Any 10000 3000 2000 1000 500. In other words a mere 10 market decline on the leveraged portfolio has turned in to a.

1718 Sector 30A Vashi Navi Mumbai 400705 Maharashtra India. Leveraged Bank Loan versus High Yield Bond Mutual Funds Ayelen Banegas and Jessica Goldenring.

4 New Free Fidelity Zero Index Funds Are They The Best

4 New Free Fidelity Zero Index Funds Are They The Best