Admiral Group ADM Ord GBP001 Sell. At the current stock.

Dividend Aristocrat Overview The Archer Daniels Midland Company

The last increase was declared on.

Adm stock dividend. The relative strength of a dividend stock indicates whether the stock is uptrending or not. The previous Admiral Group dividend was 362p and it went ex 9 months ago and it was paid 8 months ago. Archer-Daniels-Midland pays an annual.

This represents an 278 increase over prior dividend payment. If the stock price drops to 30 we would have a 7 return from the stock which would bring this to 11. 8 Zeilen Archer-Daniels-Midland NYSEADM Dividend Information.

MAY 03 0800 PM EDT. AMD Advanced Micro Devices Dividenden CHART in USD. 1999 2004 2009 2014 2020 2023.

So cash flow return is. 19 Zeilen Archer Daniels Midland Co. Grades are relative to the Consumer Staples sector.

There are typically 2 dividends per year excluding specials and the dividend cover is approximately 10. Shareholders who purchased ADM prior to the ex-dividend date are eligible for the cash dividend payment. 700p 024 FTSE 100.

Inv VTSMX Primary Inst VITSX Inst VTSAX Inst VSMPX Inst VSTSX VTSAX Mutual Fund Vanguard Total Stock Market Index Fund. 116 Zeilen 5 Stock Dividend. Data is currently not available.

Archer Daniels Midland ADM Declares 036 Quarterly Dividend. The dividend is payable on June 9 2021 to shareholders of record on May. Ex Dividend Date Record Date Payment Date Total Normal Special.

Years of Dividend Payments. Archer Daniels Midland ADM Raises Quarterly Dividend 28 to 037. ADM has a consistent history of declaring a dividend increase each February typically announced in conjunction with the Q4 earnings release.

The major determining factor in this rating is whether the stock is trading close to its 52-week-high. We believe the stock has a positive long-term. ADM Board of Directors has declared a cash dividend of 370 cents per share on the companys common stock.

ADM investor presentation Earnings per share are 319 we can assume growth of 4 over the long term and a terminal value at a PE ratio of 12. ADM has a dividend yield above 3 which is attractive in a low interest rate environment and a long history of raising its dividend each year. Archer-Daniels-Midland Company Common Stock ADM Nasdaq Listed.

033 049 DATA AS OF May 07 2021.

Dividend Aristocrat In Focus Archer Daniels Midland Company Adm Moneyinvestexpert Com

Dividend Aristocrat In Focus Archer Daniels Midland Company Adm Moneyinvestexpert Com

Dividend Aristocrat In Focus Archer Daniels Midland Company Adm Moneyinvestexpert Com

Dividend Aristocrat In Focus Archer Daniels Midland Company Adm Moneyinvestexpert Com

How Safe Is Archer Daniels Midland S Dividend The Motley Fool

How Safe Is Archer Daniels Midland S Dividend The Motley Fool

Archer Daniels Midland Co Adm Dividends

Archer Daniels Midland Co Adm Dividends

Archer Daniels Midland A Top Ranked Safe Dividend Stock With 4 1 Yield Adm Nasdaq

Archer Daniels Midland A Top Ranked Safe Dividend Stock With 4 1 Yield Adm Nasdaq

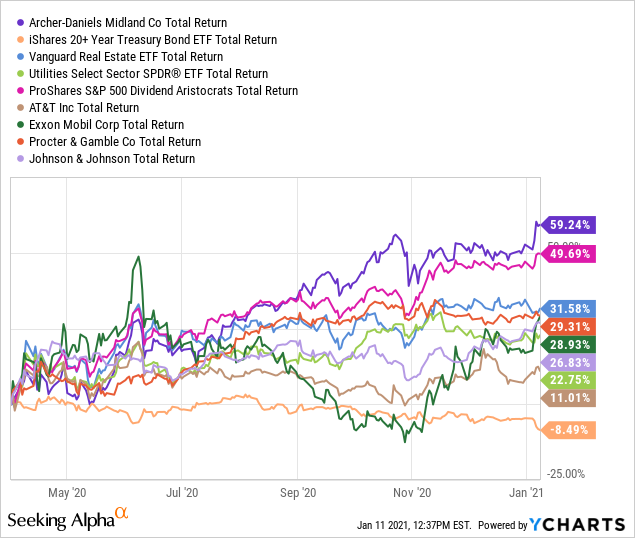

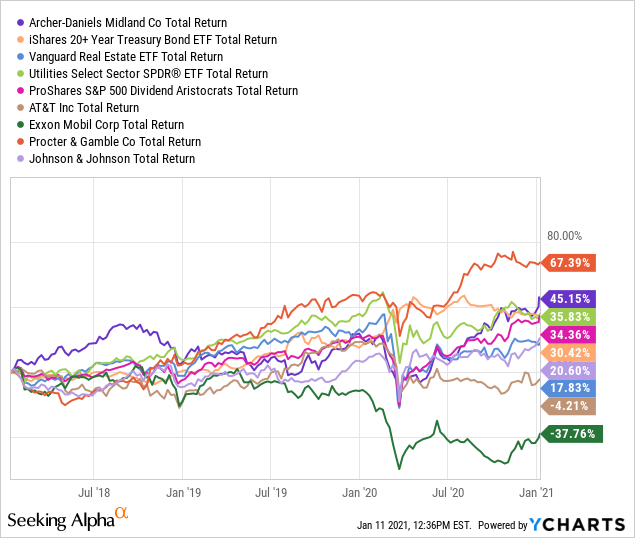

Archer Daniels Midland The Smartest Dividend Growth Play On Inflation Nyse Adm Seeking Alpha

Archer Daniels Midland The Smartest Dividend Growth Play On Inflation Nyse Adm Seeking Alpha

Dividend Aristocrat In Focus Archer Daniels Midland Company Adm Moneyinvestexpert Com

Dividend Aristocrat In Focus Archer Daniels Midland Company Adm Moneyinvestexpert Com

Archer Daniels Midland Adm D Gurufocus Com

Archer Daniels Midland Adm D Gurufocus Com

Adm Financials Dividend Information

How Safe Is Archer Daniels Midland S Dividend The Motley Fool

How Safe Is Archer Daniels Midland S Dividend The Motley Fool

Archer Daniels Midland The Smartest Dividend Growth Play On Inflation Nyse Adm Seeking Alpha

Archer Daniels Midland The Smartest Dividend Growth Play On Inflation Nyse Adm Seeking Alpha

Dividend Aristocrats In Focus Archer Daniels Midland

Dividend Aristocrats In Focus Archer Daniels Midland

Adm Dividend Stock To Buy 87 Years Of Dividend Growth Youtube

Adm Dividend Stock To Buy 87 Years Of Dividend Growth Youtube

Adm Stock Analysis Archer Daniels Midland Dividend Stock Analysis Top Dividend Aristocrat Stocks Youtube

Adm Stock Analysis Archer Daniels Midland Dividend Stock Analysis Top Dividend Aristocrat Stocks Youtube

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.