You can get a conventional FHA or VA mortgage through Quicken Loans but not a USDA mortgag. Other forms and documents you may need include.

Documents You Need To Bring To Your Tax Appointment Zing Blog By Quicken Loans

1098 paperless statement Quicken Loans Servicing Taxes As of December 19 2017 MyQL is now referred to as Rocket Mortgage.

Quicken loans tax documents. Receipts and acknowledgements for charitable contributions. Quicken Loans Fees and Services Quicken Loans. Choose File menu File Import TurboTax File.

Choose Tools menu Category List. 2000 - 2021 Quicken Loans LLC. If not add your 1st 1098.

At one point we made the decision to refinance with Quicken. 1098 forms showing interest on student loans or mortgages. All individuals that receive income tax documents need to bring those to their tax preparer advised Robbins.

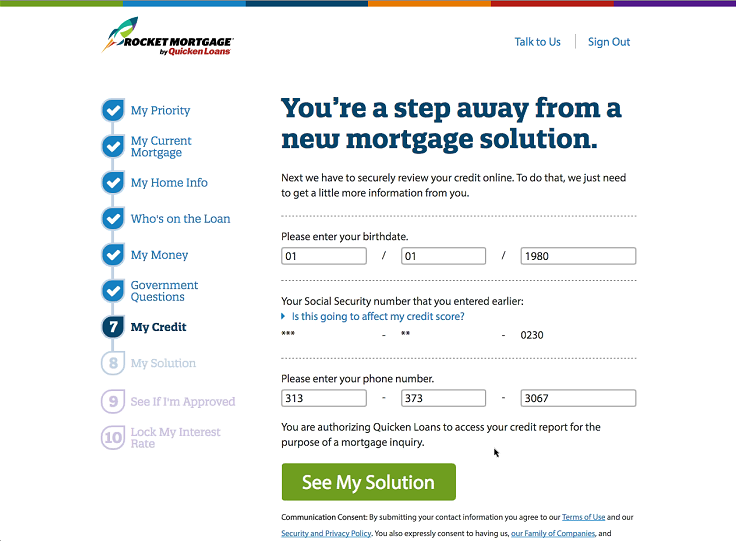

Type 1098 in the box then select GO. The loan rep Delante McGrew emailed us the loan application and asked us to e-sign the documents. After some discussion we decided to proceed and give them our detailed financial information so they could put together the numbers for us.

Choose Export Data To tax export file. You can manage your loan online set up payments and have easy access to tax-related documents. The Tax Line Item column shows which categories are tax-related and the tax line item linked to each.

Lending services provided by Quicken Loans LLC doing business as Rocket Mortgage a subsidiary of Rocket Companies Inc. 1099 forms showing self-employment stock trading interest or dividend incomes. If youre looking for guidelines on how long to keep documents not associated with your taxes the American Institute of CPAs has some good advice.

Every person that files a tax return needs to have their identification Social Security number or ITIN. If you dont have a Social Security number youre required to have an ITIN. If you have a regular job your employer will provide you with a W-2 form that reports your income as well as the tax contributions made against your income from each paycheck.

In the File name field enter a name for the file and click Save. Please note from Quicken 2010 for Windows and newer there are no auxiliary files. According to the IRS the ITIN is a tax processing number only available for certain non-resident and.

The following lists provide the Quicken data file set extensions in Windows Mac and DOS. Quicken Loans is a registered service mark of Intuit Inc used under license. Importing TurboTax data gives you a head start in developing your tax estimate and can save you a lot of data entry time.

Profit and loss forms might include a Schedule C Form 1120S or K-1 depending on your business structure. Refer to the manufacturers instructions for your tax software for information about how to import the TXF file that was created. If you dont see the Tax Line Item column click the Gear icon and choose Tax Line Item.

Mortgage interest is fully tax deductible in most cases. Additionally if you run a quick app store search on the smartphone platform of your choice there are many apps that will let you scan documents with the snap of your phones camera. If yours does have a copy of your state return available as well as your federal return.

Many of these perform optical character recognition so that the. To review and change Quickens tax-related categories. The big document at tax time is the W-2 you receive from your employer.

Quicken Loans responded to our internet request for quotes from lenders regarding the refinancing of our mortgage. Im also going to get this over to our Client Relations team to. Speak with a Home Loan Expert regarding your options.

Summary List Placement Quicken Loans is an online lender that offer term lengths as short as eight years. In the Save in field select a location for the file. Your previous years tax return.

Youll apply through its digital platform Rocket Mortgage and Quicken Loans underwrites the loan. If you paid 600 or more in mortgage interest this past year your lender will send you a 1098 statement to include with your tax return. Your W-2 from your employer.

While the specific forms necessary are dependent on how you incorporate your business in general well need personal tax returns and if its a corporation W-2s as well as a statement showing your portion of the businesss profit or loss. You should land on the Mortgage deduction summary page if you have previously entered a 1098. Select the TurboTax data file you want to import.

The other extensions are auxiliary files that contain supporting data such as online banking setup or tax profile information. The first file listed is the primary data file. After entering your 1st 1098 select the Add a lender button at the bottom of the summary page and repeat steps for the additional 1098 form.

Quicken Loans strongly encourages its clients to consult with a tax professional before making any timing decisions related to the payment of property taxes that could result in substantial differences of overall income taxes owed andor the timing of such payments especially in a year such as 2017 when significant changes to the tax code have taken place. If you have your previous years TurboTax data file you should import it into Quicken before you begin using the Tax Planner. Quicken Loans 1050 Woodward Avenue Detroit MI 48226-1906.