6 The future of growth and the banking industry Value matters more than volume With customers more willing to try new competitive offerings that let them conduct transactions on their own terms institutions are challenged to balance the more costly high-touchhigh-value products and services against the pressures to generate revenue. Six digital growth strategies for banks Despite the headlines about digital disruption in financial services big banks are actually holding their own.

Banking In Turmoil Strategies For Sustainable Growth 9780230235717 Economics Books Amazon Com

Banking In Turmoil Strategies For Sustainable Growth 9780230235717 Economics Books Amazon Com

This identifies four interconnected elements as the key to growth.

Banking strategies for growth. Better tech is the key to better banking regulation Protecting customers and staying onside with the regulators are perennial challenges for financial services organizations. The dramatic changes in consumer and. Banks have long relied on making customers aware of relevant products as a path to growth.

It supports clients to identify the most suitable path for growth. Tap into New Markets Cooperative marketing can help your bank build new relationships and it can also help you find new markets like homebuyers who need to take out loans or the parents of young children who are looking to start bank accounts. As you plan a deposit growth strategy for your community bank or credit union consider these essential tactics for increasing core deposits.

Local search engine optimization SEO ensures prospects will find you online According to the CA Web Stress. PNC Bank took a similar approach which enabled them to drive more branch traffic and acquire accounts at a lower cost. Growth strategies Former Radius chief brings fintech mentality to New York de novo Michael Butler relied on partnerships with tech startups in areas such as checking and mobile banking to turn Radius into a digital-only bank before its sale to LendingClub.

This includes discussion of market penetration market development product development and diversification together with evaluation of such growth strategies. Grow beyond your core into relevant ecosystems. Change the customer conversation.

In the past that approach was about introducing other banking products. Growth target areas for growth generation optimal growth portfolio and effective execution. Our Growth Cycle was developed as a strategic framework for sustaining value-enhancing growth see Figure 2.

Our Growth system is a strategic framework to sustain value creating growth that consists of four cornerstones. Globally financial-services revenues have grown 4 percent annually over the past ten years thanks largely to growth in emerging markets and fintech start-ups and large tech companies have so far captured only tiny slivers of market share. 1 Defining an appropriate growth target.

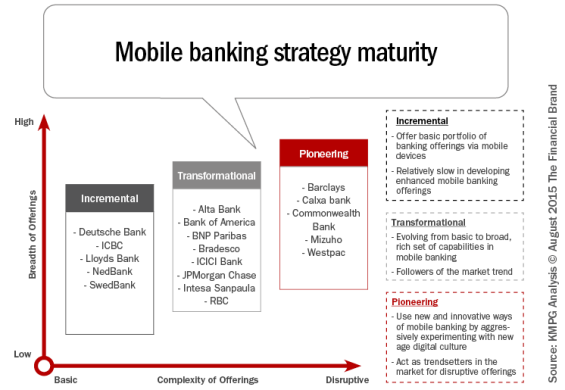

Harnessing the creativity and passion of. A framework is presented for thinking about the various avenues through which banks can pursue growth. In our survey 78 of respondents reported that improving sales skills was their banks primary strategy for growth.

To provide a structure for navigating this chaos and to galvanize the shift to bolder thinking weve identified six opportunities for banks to fuel future growth. This growth strategy aims to sell more financial services to the companys current markets. Thanks to rising interest rates lower corporate taxes and easing of regulations the prospects for higher bank profits are bright.

The positive trends provide management teams with options regarding where and how to invest in their business according to Capital Performance Groups analysis of the banking industrys 2017 financial performance. Based on the Igor Ansoff Matrix Bank of Americas main intensive growth strategy is market penetration. For most banks and in most markets reducing branch networks while at the same time taking steps to optimize the remaining branches 2 to 8.

Intensive Strategies for Growth. The few experience leaders emerging in retail banking are generating higher growth than their peers by attracting new customers and deepening relationships with their existing customer base. On this weeks podcast Alliance for Innovative Regulations David Ehrich discusses how technology is helping now and how better tech could help even more.

We have undertaken extensive research to identify the secrets of successful growth companies in banking. Highly satisfied customers are two and a half times more likely to open new accountsproducts with their existing bank than those who are merely satisfied. Much of Bank of Americas growth is based on market penetration leading to the companys current competitive position as one of the largest banks in the world.