But If Prosper raises its interest rates then it becomes less compelling to the borrowers. Is Prosper a strong investment that you really should be thinking about.

Prosper Review 2021 Are They Worth A Second Look

Prosper Review 2021 Are They Worth A Second Look

Its also a great way to invest when you only have a little money.

Is prosper a good investment. Do your own research before investing in somethingfinancialandinves. Videos you watch may be added to the. I would not doubt that some lenders take out Prosper loans after losing money through their investments and after finding out how easy it is to steal money from Prosper investors.

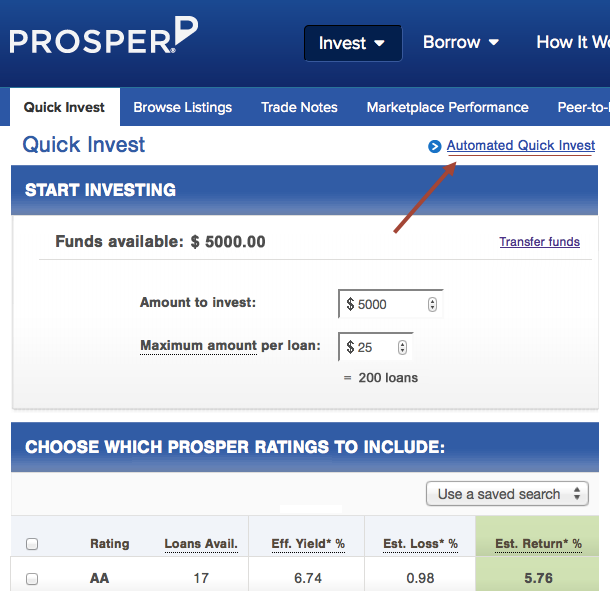

With Lending Club you must invest in multiples of 25 whereas Prosper allows any amount of at least 25. Diversified from within it can be a great addition to any portfolio and in many years has outperformed more traditional investment types like index funds. Is investing in Prosper a good idea.

Prosper only requires the investor. The minimum needed to open an account with Prosper is 25. Based on our forecasts a long-term increase is expected the price prognosis for 2026-05-02 is 39652 US Dollars.

Theres not much margin to give good. Prosper can be a good investing option. Prosper price equal to 5758 USD at 2021-05-04.

Prosper is a good option for people with a balanced portfolio who want to diversify their investments in a socially impactful way. But it is a riskier option than bank investments. The benefits of a peer to peer IRA are awesome.

Prosper is a peer-to-peer lender that provides personal loans to borrowers with fair or good credit. In the end investing in Prosper may help others. Now that weve seen prosper fail to give higher returns why would an investor put money in Prosper over say buying junk bonds or ultra safe treasuries.

How to Safely Invest using Prosper - YouTube. I recently had someone ask me if it was wise to invest in LendingClub or Prosper. If playback doesnt begin shortly try restarting your device.

The company says it has originated more than 17 billion in loans to over 1 million people since. Its not because Prosper is a bad idea as a matter of fact that couldnt be further from the truth. Prospers advantage for lenders seemed to be the promise of higher returns.

Heres what you should know. Well thats not my call thats up to you and your securities advisor. According to the Prosper website the company has issued 16 billion in loans to more than one million customers making them a reputable lender.

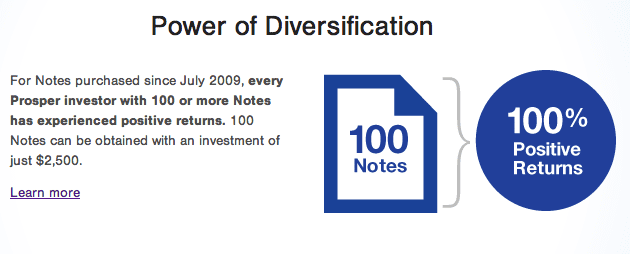

Its generally because these people have abnormal profiles read. This makes them remarkably stable compared to many traditional investments. For instance the average credit score of borrowers at Prosper is 700.

For those of you who do not know what these are they are peer-to-peer lending institutions that usually allow people to borrow money for less than they could at a traditional bank. Investing in loans through Prosper can be a unique way for investors to diversify their portfolios. Is prosper a good lender.

Prosper is a good option for people with a balanced portfolio who want to diversify their investments in a socially impactful wayIts also a great way to invest when you only have a little money. Prosper is a great company but because every portfolio is unique without knowing you personally I wouldnt be justified in giving you advise with regard to investments. Prosper and Lending Club both allow investors to invest a minimum of 25 per note but Prosper gives a little more flexibility here.

In conclusion Prosper is a simple idea that provides real returns for a diverse class of investors. Lower credit scores so they go the route of peer-to-peer lending. Prosper lending was never a good investment but lately the bottom has fallen out of it.

However the fees and potential restrictions make investing through Prosper complicated. While peer to peer lenders often forfeit a solid portion of their investment to taxes Prosper helpfully offers their lenders the ability to open a self-directed IRA regular or Roth or roll over a 401k. I dont see Prosper having any advantage for an investor right now unless they raise rates.

The pros of investing with Prosper. If you buy Prosper for 100 dollars today you will get a total of 17367 PROS. Qualifying borrowers can borrow with no collateral though interest rates can be high if you dont have excellent credit.

For taxable accounts Lending Clubs minimum is 1000 but I dont think thats a bad thing 1000 is the minimum that any investor. Prosper is an online banking that allow you to invest and borrow money in the platform. Alongside the phenomenon of compound interest is the wonder of tax-free investing.

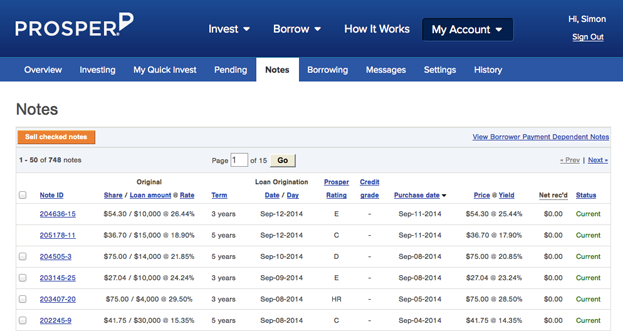

The default rate in Prosper loans is greater than many other programs and it is entirely due to Prospers sloppy vetting of. Prosper Investment Risks. The platform provides a good amount of detail about borrowers.

If you are looking for virtual currencies with good return PROS can be a profitable investment option. Reason 2 Prosper investments are trustworthy Prosper lends your cash to prime-rated borrowers meaning people with good credit history who are likely to pay back their debts. In the end investing in Prosper may help others who may not.

You can read questions and comments from real investment users all around the web but the general consensus seems to be that Prosper is great for investors who are willing to spend a little time with Prospers. If you live somewhere with few restrictions and want to add some unique investments to your portfolio Prosper is a good choice but most people will be fine with a more traditional investment strategy.

Is Prosper A Good Investment Modest Money

Is Prosper A Good Investment Modest Money

Prosper Vs Lendingclub Investor Experiment 2 5 Year Update My Money Blog

Prosper Vs Lendingclub Investor Experiment 2 5 Year Update My Money Blog

Prosper Com Review For New Investors Lend Academy

Prosper Com Review For New Investors Lend Academy

Lending Club Vs Prosper 2021 Which Is Better For Investing

Lending Club Vs Prosper 2021 Which Is Better For Investing

Prosper Com Review For New Investors Lend Academy

Prosper Com Review For New Investors Lend Academy

Prosper Invest Review Worth It Or Not Youtube

Prosper Invest Review Worth It Or Not Youtube

Prosper Review 2021 Are They Worth A Second Look

Prosper Review 2021 Are They Worth A Second Look

Prosper Com Review For New Investors Lend Academy

Prosper Com Review For New Investors Lend Academy

Prosper Com Our Review Of Prosper

Prosper Com Our Review Of Prosper

Prosper Review 2021 Is It A Good Investment Learnbonds

Prosper Review 2021 Is It A Good Investment Learnbonds

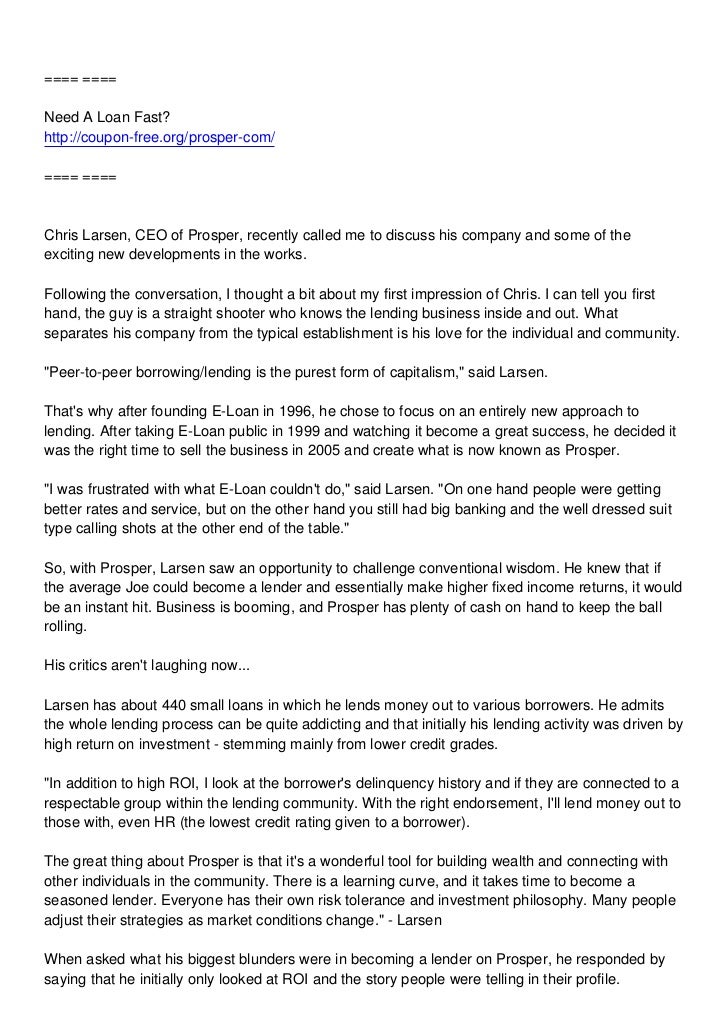

Prosper My Interview With Chris Larsen Ceo

Prosper My Interview With Chris Larsen Ceo

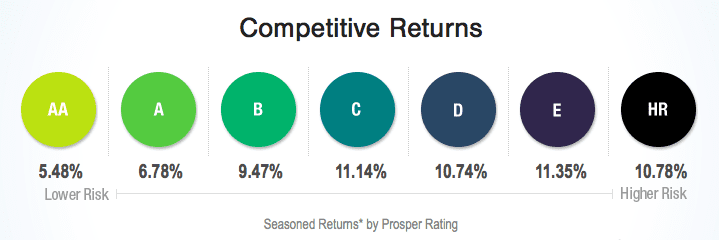

Prosper Investor Review Invest Like A Bank Earn 5 9

Prosper Investor Review Invest Like A Bank Earn 5 9

Prosper Review A Great Peer To Peer Lending Platform

Prosper Review A Great Peer To Peer Lending Platform

Prosper Investor Review Invest Like A Bank Earn 5 9

Prosper Investor Review Invest Like A Bank Earn 5 9

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.