This category can include corporate. The strategy earns a Morningstar Analyst Rating of Neutral.

Strong Demand For Muni Etfs Etf Com

Strong Demand For Muni Etfs Etf Com

The management trio leading.

Ultra short muni etf. The largest Ultra-Short Term ETF is the JPMorgan Ultra-Short Income ETF JPST with 1688B in assets. Ultrashort bond portfolios invest primarily in investment-grade US. Investment ObjectiveStrategy - First Trust Ultra Short Duration Municipal ETF seeks to provide federally tax-exempt income consistent with capital preservation.

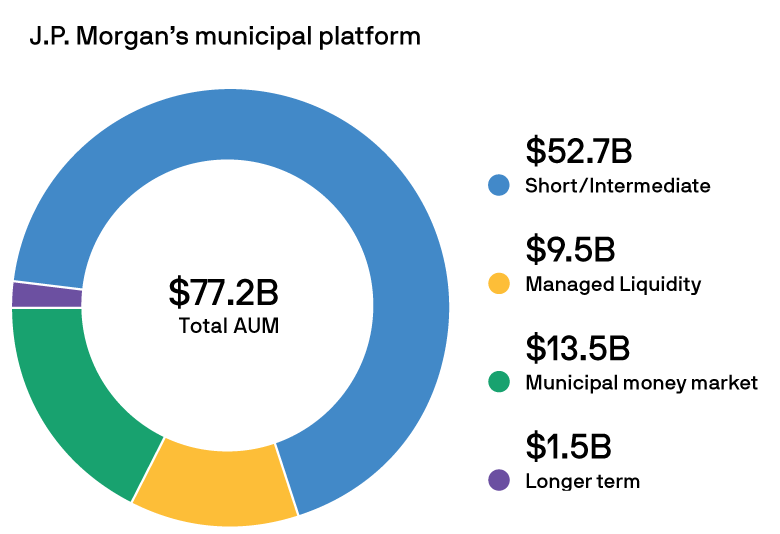

Vanguard Short Term Bond ETFs are funds that focus on the shorter maturity and duration scale of the domestic fixed-income market. JPMorgan Ultra-Short Municipal Income ETF JMST is managed by experienced leaders through a sensible process. The fund seeks to provide attractive after tax income from a nationally diversified portfolio of primarily short duration high credit quality bonds which are exempt from federal tax and in some cases state tax.

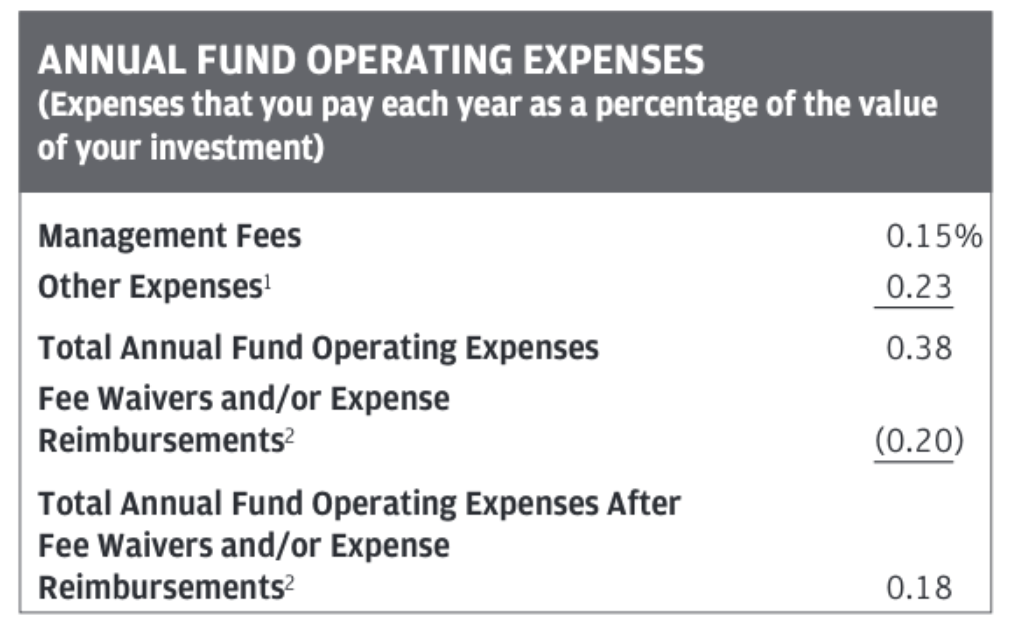

JMST which has a 018 expense ratio. Fixed-income issues and have durations typically of less than one year. The new active muni bond ETF.

VanEck Vectors Short Muni ETF. The fund seeks to provide portfolio diversification relative to mainstream stocks and bonds. The metric calculations are based on US-listed Ultra Short-Term ETFs and every Ultra Short-Term ETF has one issuer.

Muni National Short-Term Bond ETFs Muni national short portfolios invest in bonds issued by state and local governments to fund public projects. VanEck Vectors AMT-Free Short Muni Index ETF. IShares Short-Term National Muni Bd ETF.

Access to a specific segment of the domestic municipal bond market 3. Here are the best Muni National Short ETFs. If an issuer changes its ETFs it will also be.

Click on the tabs below to see more information on Vanguard Short. ETFS Ultra Short Nasdaq 100 Hedge Fund ASX Code. Use to seek tax-exempt income and manage interest rate risk.

These are generally bonds with maturities of less than seven years and can include corporates Treasuries agencies as well as other bonds like TIPS. The VanEck Vectors Short High Yield Muni ETF SHYD seeks to replicate as closely as possible before fees and expenses the price and yield performance of the Bloomberg Barclays Municipal High Yield Short Duration Index BMHYTR which is intended to track the overall performance of the US. The income from these bonds is generally free from.

In the last trailing year the best-performing Ultra-Short Term ETF was KCNY at 1578. Under normal market conditions the Fund seeks to achieve its investment objective by investing at least 80 of its net assets including investment borrowings in municipal debt securities that pay interest that is exempt from regular. Exposure to short-term US.

ETF issuers who have ETFs with exposure to Ultra Short-Term are ranked on certain investment-related metrics including estimated revenue 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields. SNAS is a trading product offering negatively geared exposure to the Nasdaq-100 Index. SPDR Nuveen Barclays Short Term Muni Bond ETF.

View performance data portfolio details management information factsheet regulatory and other documents. Morgan Asset Management rolled out the actively managed JPMorgan Ultra-Short Municipal ETF Cboe. Some ultra short term bonds may include a small part of the portfolio in high yield bonds to increase yield.

Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund or ETF before investing. Ultra short term bond ETFs usually have a duration of less than 1. Ultrashort Bond ETFs Ultrashort-bond portfolios invest primarily in investment-grade US.

On Thursday JP. SPDR Nuveen Blmbg Barclays ST MunBd ETF. Fixed-income issues and have durations of less than one year or if duration is unavailable average effective maturities of.

The summary and full prospectuses contain this and other information about the mutual fund or ETF and should be read carefully before investing. To obtain a prospectus for Mutual Funds. Dollar denominated high yield short-term tax-exempt bond market.

Contact JPMorgan Distribution Services Inc.

Jpmorgan Ultra Short Municipal Income Etf J P Morgan Asset Management

Jpmorgan Ultra Short Municipal Income Etf J P Morgan Asset Management

Muni Etfs Walk Into Spotlight Etf Com

Muni Etfs Walk Into Spotlight Etf Com

Jmst An Interesting Short Term Muni Etf Bats Jmst Seeking Alpha

Jmst An Interesting Short Term Muni Etf Bats Jmst Seeking Alpha

Etfgi Assets In Etfs Etps Listed Globally Are Again Over The 6 Trillion Us Dollar Etfworld Fr

Etfgi Assets In Etfs Etps Listed Globally Are Again Over The 6 Trillion Us Dollar Etfworld Fr

J P Morgan Launches First Ultra Short Muni Bond Etf

J P Morgan Launches First Ultra Short Muni Bond Etf

Why Jmst Solve Income Challenges With An Ultra Short Municipal Bond Etf

Why Jmst Solve Income Challenges With An Ultra Short Municipal Bond Etf

Muni Bond Etf Activity Grows Etf Com

Muni Bond Etf Activity Grows Etf Com

Jp Morgan Launches Active Ultra Short Fixed Income Etf Etf Strategy Etf Strategy

Jp Morgan Launches Active Ultra Short Fixed Income Etf Etf Strategy Etf Strategy

Jp Morgan Launches Ultra Short Muni Bond Etf Etf Strategy Etf Strategy

Jp Morgan Launches Ultra Short Muni Bond Etf Etf Strategy Etf Strategy

How To Pick A Muni Bond Etf Etf Com

How To Pick A Muni Bond Etf Etf Com

How To Pick A Muni Bond Etf Etf Com

How To Pick A Muni Bond Etf Etf Com

Muni Bond Etf Activity Grows Etf Com

Muni Bond Etf Activity Grows Etf Com

Jpmorgan Ultra Short Municipal Income Etf J P Morgan Asset Management

Jpmorgan Ultra Short Municipal Income Etf J P Morgan Asset Management

Strong Demand For Muni Etfs Etf Com

Strong Demand For Muni Etfs Etf Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.