If your account balance is below 1500 you wont earn dividends. Thumbs up this video and SUBSCRIBE it helps me learn who enjoyed this video to create more content for you all.

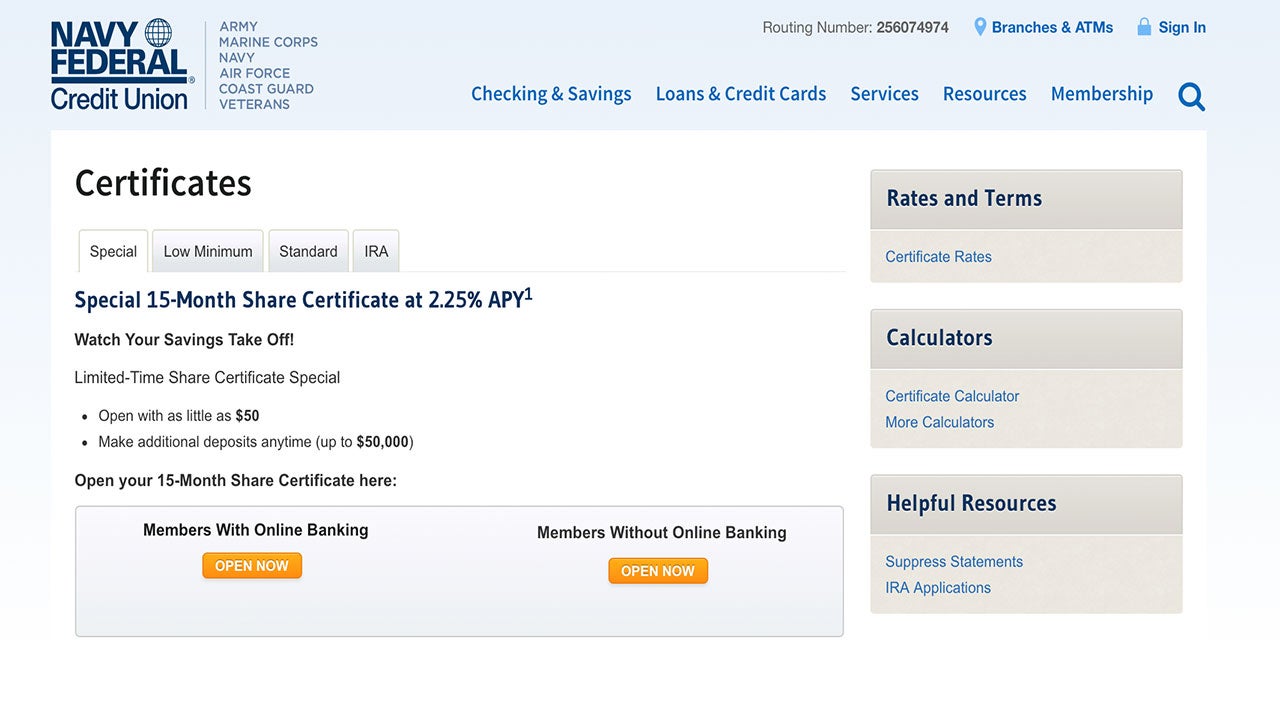

Navy Federal Credit Union S Amazing Cd Deal Bankrate Com

Navy Federal Credit Union S Amazing Cd Deal Bankrate Com

When I was in the Navy I opened my account with them because it was an accessible brick and mortar with a branch on nearly every base.

How much is it to open a navy federal account. See if opening up an account with this bank is in your best financial interest. Otherwise a 20 monthly service fee will apply. SmartAssets experts review Navy Federal Credit Union.

Tiered dividends based on balance start earning dividends with an average daily balance of at least 1500 ATM fee rebates with direct deposit up to 120 a year 8. For Flagship Checking no monthly service fee if average daily balance is 1500 or more. There is no minimum deposit to open the account but you might have to pay a monthly fee.

In this video I will go ov. If your balance is more than the 1500 threshold you wont have to pay any monthly fees. A savings account may not be used for.

Listed on Navy Federals current. Start Minor Membership Application. 10 if less than 1500.

The fee will be assessed until you meet one of the criteria listed above or the Membership Savings Account is closed thereby terminating your membership. Generally interest rates increase the longer you invest in these options. Navy Federal has some of the best loan rates around and its much easier to get a loan with them if you already have an account.

Last December I reported on a little-known way to qualify for Navy Federal Credit Union Navy Fed membership. To open a Navy Federal business checking account youll need to have Business Membership of the credit union. This means that youll first need to be an individual member with an account in good standing.

Schedule of Fees and Charges. Money Market Savings Account 1. 10 if less than 1500.

Typically 25 to 100 depending on the financial institution. If youre an existing member and a parent grandparent or guardian share the gift of membership with someone under 18 using our online minor membership application. We give an overview of all the banks account offerings rates and fees as well as branch locations.

This backdoor to Navy Fed membership has been closed. When opening an account the contribution limit for the current tax year is 5500. In this Navy Federal Credit Union Savings Account review well compare rates fees and services to other national and online banks.

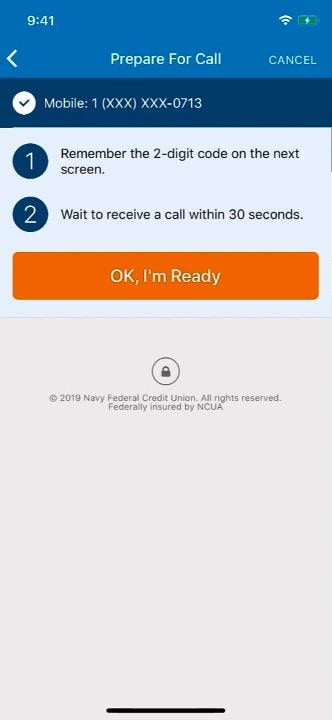

Direct deposit is available and can be set up online. Take advantage of higher dividends in exchange for a minimum balance of 2500 2 or more. Or visit a branch or call us at 1-888-842-6328 to learn about opening a minor membership.

The backdoor involved joining the Navy League San Diego Council and then going through a special Navy Fed membership application process. Navy Federal requires a minimum deposit of just 5 when you become a member and open a savings account. Once this happens you must be in Navy Federals field of membership to reopen the account.

Share Certificates are the Navy Federal Credit Union s standard CDs and you can open an account for terms ranging from three months to seven years with a minimum deposit of 1000. To become a member you need to open a Navy Federal savings account which requires a minimum deposit of 5. The APY is going to be significantly higher with this account compared to the other accounts.

Youll also have to deposit 100 in the business account at the time of opening. The NFCU Traditional IRA does not have a minimum deposit. If youre interested in opening a savings account at Navy Federal Credit Union you need to be a member.

No monthly service fee if average daily balance is 1500 or more. Catch-up contributions of an additional 1k are available for individuals 50 and over.